The Great Taking

Maybe just start with the national debt, nearing $34 trillion. You’re tired of hearing about it. It comes across as somehow abstract – after all, million, billion, and trillion all sound alike – making it hard to get your head around the enormity of the number until you realize the cost of just servicing it rivals the entire military budget. Triple that number to account for the country’s additional but uncounted financial commitments e.g. Social Security and Medicare.

Then, of course, it’s subject to what Einstein described as the most powerful force in the universe i.e. compounding interest. Anyone with a pocket calculator can readily see there is absolutely no chance of our growing out of this black hole. Free dessert to anyone who can come up with a credible scenario outside of outright default, whether it be literally or in some other guise e.g. reset (CBDC), debt jubilee, or hyperinflation.

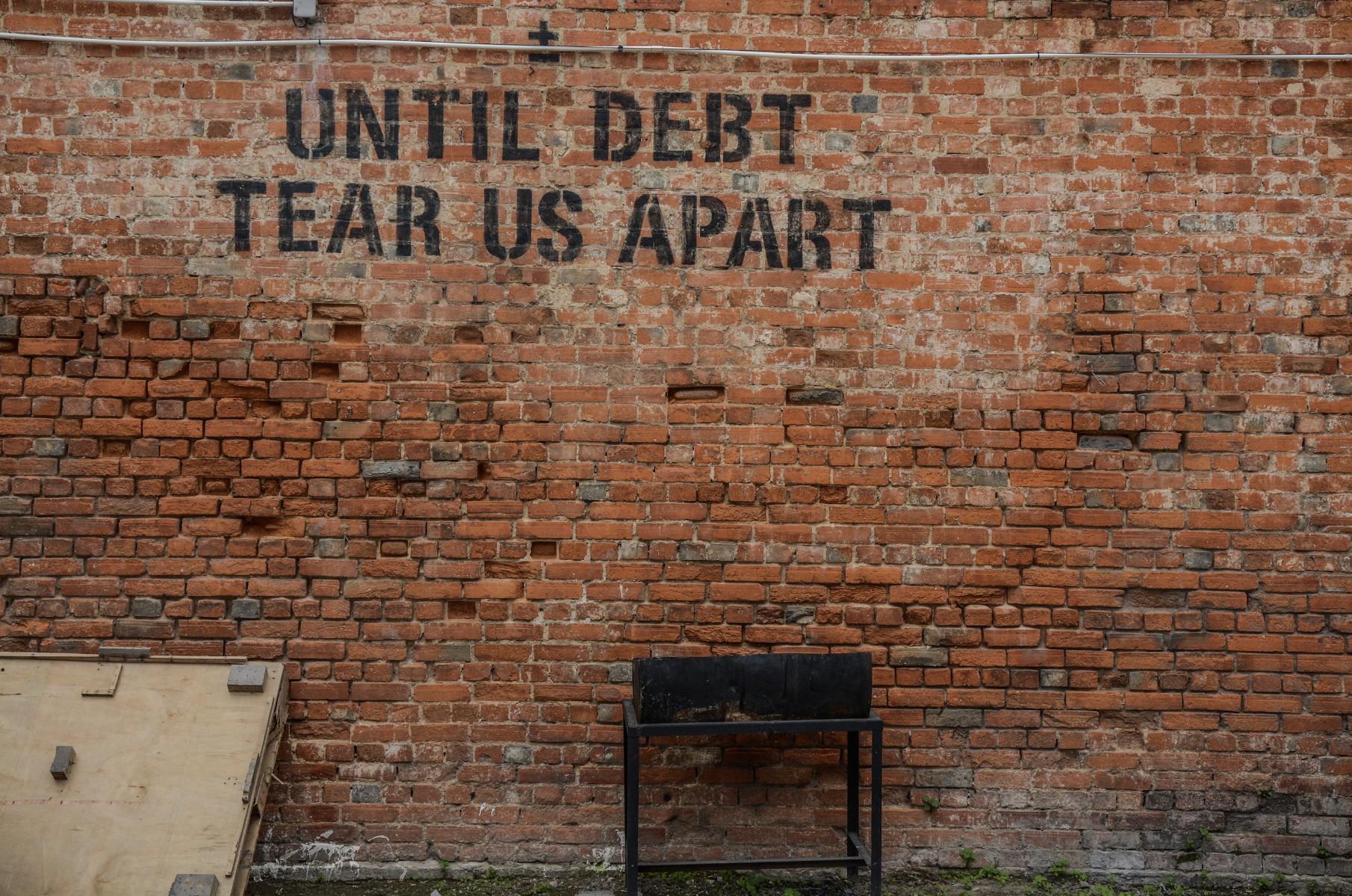

Our discussion, though, is not even about the national debt per se. It’s something bigger – it’s about a mindset that’s been seduced by decades of magical thinking about debt in a hyper-financialized world. No one can even describe what money even means anymore. The financial system has long become detached from the real world. Start with that massive amount of money that’s “printed” by the central bank, far in excess of what’s needed to support normal economic activity.

That financial excess works its way through so many intellectual abstractions – derivatives, tranche packaging, off balance sheet financing, special purpose entities – that the very idea of risk is lost. It has given birth to perverse incentives. Those outside the money-creation system can only stare in blank incomprehension as debt levels have continued to pile up at every level, in every sector.

Our focus piece, a documentary well worth its roughly one hour duration (The Great Taking), punctures the illusion. We are invited to see the world through a different lens. View the piece as a working hypothesis delivered by someone who has served and survived the hardest edges of the financial world i.e. hedge funds, M&A, and private equity. He is now on the outside looking in, with nothing left to prove other than to deliver a message. Be aware.

His working hypothesis starts with the description of the massive fund flows that had been created by the Fed (roughly one percent per week) far ourstripping any real economic growth. Another way of expressing that economic phenomenon is to cite the sharp drop in the velocity of money (economic growth versus money creation), lower now than during the Great Depression. He follows the implications of money creation that far outstrips real economic growth.

Among them is ownership distortion. On the asset side, you may be surprised to learn the extent to which the ownership of certain assets may be altered in times of “stress” e.g. those shares of stock you hold in your account may be deemed to be a security “entitlement,” something less than simple ownership title and junior to the rights of the senior creditors to your custodian (Schwab, E.Trade). You may also be surprised to learn that what you thought were your “demand deposit” rights in your bank account simply make you a creditor to the bank were it to run into trouble. So, are there any signs of trouble?

The documentary describes the immense growth in the so-called derivatives complex which represented ten times global GDP even back during the financial crisis of 2008 and is now far outstripping the real world economy. That was about the time the whole notion of rational credit rating was replaced by what’s called the securitization of loans i.e. obscure pool packages generating artificially high credit ratings through the magic of those pseudo-insurance vehicles (CDOs packaged into separate limited liability entities). On top of that, these pool packages had themselves been sold multiple times over into a derivatives market where losses could be (and had been) papered over by some of that excess money printing. Welcome to the world of sleight-of-hand financialization.

(You may also be interested in the implementation of all those legal and financial fictions that came out around the time of the financial crisis e.g. the previously-mentioned stock “entitlement” distinction to a host of other changes in the applicable state and the bankruptcy code specifically designed to protect certain “special interests.” The net is that most of your “segregated” asset holdings are actually held in “pooled form,” providing you only a pro-rated (and subordinated) interest. Any such pooled interests are subject to the financial integrity of national and international clearing facilities, themselves subject to insolvency risk. The net of all this is that in the event of a cascading default your hold on assets is far more tenuous than you may have thought.)

The fact is the world of financialization is so maddingly obscure that it leads to a legitimate question about whether this obfuscation was an intention all along. For even as ownership interests may be tenuous, conditional, and uncertain in times of financial distress, the consequences of unserviced debt, especially secured debt, certainly are not.

A lesson from the 1930s is that asset foreclosures can be executed as a matter of summary judgment with minimal judicial review. The triggering catalyst threatening this massive global debt bubble is the rise in interest rates.

Okay, depending on your level of intellectual curiosity (or perhaps your level of paranoia), we will continue down this rabbit hole but suffice it to say “the great taking” is a reference to the mother of all foreclosures, of assets on a global scale. The collateral in question is company stock and the issue at hand is control.

If granted one wish, it would be to be placed in the oval office on Christmas eve, eve of 1913 as President Wilson, pen in hand, was about to sign into law the Federal Reserve Act whereupon a discussion would ensue about the danger of the private control of money supply, he could view this focus documentary and be invited to join our upcoming MM session.