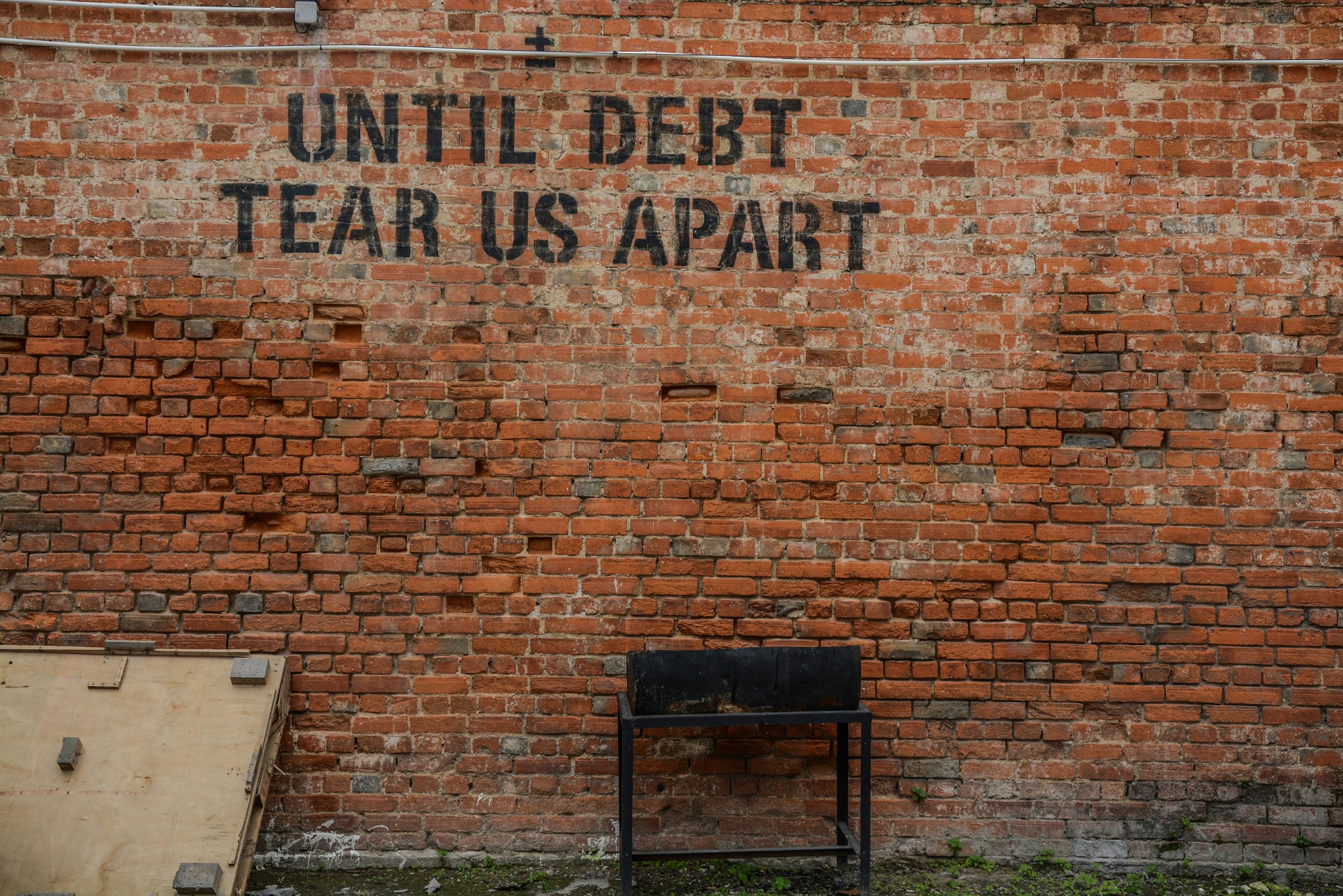

Debt Jubilee

Our challenge for this session is to peek behind the gaslighting known as modern economic theory and ponder the realities of our national debt, now $35.28 trillion. And climbing. Exponentially. The national debt actually increased by $17.96 trillion over the last ten years. For some context, total consumer debt – all the mortgage, auto, credit card, and student loan balances – is another $17.80 trillion.

In other words, just the increase in our national debt over the past decade went up by the same amount as the sum of all existing private debt currently owed by the entire population. (By the way, the national debt number doesn’t even include so-called unfunded liabilities like social security and medicare which, if included, would roughly triple that official debt number.)

Here’s the ultimate prize – yes, a free dessert – for the first person to offer any credible, or even an incredible, plan to grow out of this existential problem, something beyond a timeline featuring a point labeled “then a miracle happens.” That challenge goes not only to the principal but to its ultimate servicing given the quote attributable to Einstein that the most powerful force in the universe is compounding interest (“eighth wonder of the world”).

Go ahead and invoke AI or phone-a-friend to come up with something beyond what spit out for me: reduce government spending; increase revenue; promote economic growth; improve debt management; address healthcare costs. Or, my favorite, establish a bipartisan commission. Yes, indeed, just be sure it's a blue ribbon.

Into the mix comes a noted financial thinker/advisor weighing in with a concept as fresh as four thousand years ago i.e. a debt jubilee (click: Lyn Alden, How Debt Jubilees Work). Debt jubilees (forgiveness), you see, were basically solutions to those systems so plagued by growing instabilities from prior generations that an entire reboot was preferable to an outright head-chopping revolution. Nothing like a clean slate of a renewed social contract. But, as they say, you have to break a few (creditor) eggs to make an omelet.

We’ve already witnessed the initial stages of the described debt jubilee as debt migrates from the bottom to the top of the debt pyramid by means of cash injections to corporations, households, and banks through various troubled asset relief programs. That accumulation then winds up on the government balance sheet which the central bank then inflates away through suppressed interest rates.

The problem comes when governments exceed a certain debt-to-GDP threshold (cited as 80%) and the private market chokes, leaving the central bank as the only buyer using freshly printed money. At some point it then becomes too late for an austerity fix as that itself kills economic growth and politicians are bumped from office.

That ship has sailed. The piece chronicles all the enabling extend-and-pretend gimmicks that have led to this point and dismisses any reference to Japan’s even worse debt ratio as being a facile and irrelevant comparison. The article’s only missing sleight of hand was some recent proposal to mint a platinum coin with a $1 trillion face value which the Treasury could use to pay off debts without raising the debt ceiling or borrowing from the Federal Reserve.

No dessert for you.